IRS Tax Refund Schedule 2026: Status, Direct Deposit Dates, Amount and More

If you’re waiting for your IRS tax refund schedule 2026, you’re not alone. Many Americans rely on their refunds to manage expenses, save, or catch up on bills. Knowing how to track your refund status, when the refund is likely to land, and what has changed for 2026 (including the phase-out of paper checks) can help you plan better.

This guide covers everything: refund status, direct deposit amounts, deposit dates, eligibility, new IRS changes, and answers to key frequently asked questions. We also written a detail blog on $3,000 IRS Tax Refund Schedule 2025 myths or fact and 500 dollar IRS tax refund 2025.

What Is an IRS Tax Refund Schedule?

An IRS tax refund is what you receive if you paid more taxes during the year — via withholding or estimated payments — than you owed, or if you’re eligible for refundable tax credits (such as the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC)). The refund is the difference, returned to you by the Internal Revenue Service (IRS).

Refunds are generally issued via:

- Direct deposit (fastest and safest)

- Electronic payments (prepaid debit cards or digital wallets, in certain cases)

- Paper checks — but this is now being phased out.

What’s New in the 2026 IRS Tax Filing Season?

For the 2026 tax filing season, the IRS has set January 26, 2026 as the official start date for most individual returns, with the deadline remaining April 15, 2026. This year’s filing season incorporates new tax law provisions that may affect credits and deductions, and the IRS continues to expand its suite of online tools and resources to help taxpayers before, during, and after filing. Taxpayers can access electronic services and guidance directly through IRS.gov to streamline their preparation and stay informed of changes.

Key Updates for the 2026 IRS Tax Filing Season

Official Start and Deadline: The IRS has announced that the 2026 tax filing season for individual returns will officially open on January 26, 2026, and the filing deadline remains April 15, 2026.

Tax Law Changes Taking Effect: Several new provisions of the One, Big, Beautiful Bill Act are now in effect for this filing season. These changes may impact federal tax calculations, credits, and deductions for taxpayers.

Online Tools and Resources: The IRS encourages taxpayers to use expanded online tools and resources available on IRS.gov throughout the filing process before, during, and after filing to help prepare, track, and manage returns.

New Forms and Schedules: Taxpayers may see updates like Schedule 1-A, which reflects new deductions (e.g., for tips, overtime, and enhanced senior deductions) under the latest tax law.

Electronic Filing Options: Electronic filing remains a central focus for faster processing, including early e-file openings for certain returns and mobile-friendly options to engage with IRS services digitally.

How to Check IRS Tax Refund Status

The IRS provides an official tool to track your IRS tax refund schedule 2025 refund progress:

Where’s My Refund? (WMR)

- You can use this at the IRS site or through the IRS2Go mobile app.

- To check your refund, be ready with: your Social Security number (or Individual Taxpayer Identification Number, ITIN), your filing status, and the exact refund amount claimed on your return.

- The tool updates once per day — overnight. No need to refresh repeatedly.

Refund Status Phases

When you log in, WMR will display one of these stages:

- Return Received — IRS got your return and is processing it.

- Refund Approved — IRS approved the refund and scheduled payment.

- Refund Sent — IRS has sent the refund to your bank or via mail.

If you don’t have internet, IRS provides a phone-based refund line.

IRS Tax Refund Direct Deposit Amount, Dates & What’s New

Direct Deposit Amount

The amount deposited depends on your calculated refund on your return — minus any offsets the IRS applies, such as unpaid taxes, past-due child support, student loans, or other federal/state debts. If your refund is reduced or offset, the IRS will send a notice explaining the reduction.

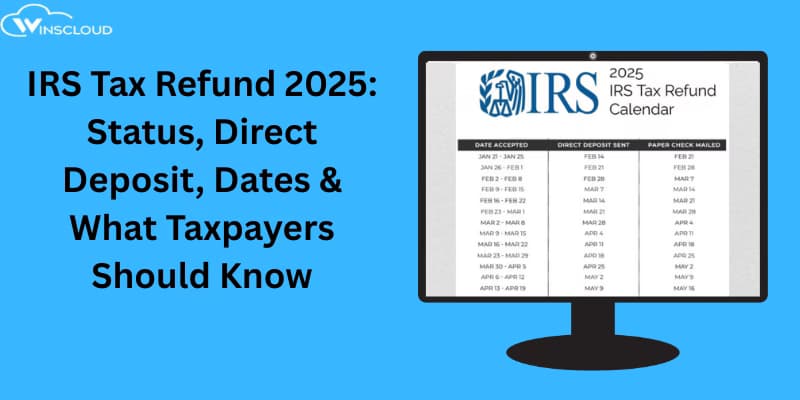

Direct Deposit Dates & Typical Timing

- If you e-file, the IRS usually processes fastest. You can check refund status roughly 24 hours after filing.

- Many refunds — for e-file + direct deposit — are typically issued within 21 days.

- If you mailed a paper return, it may take ≈ 4 weeks or more to show status or get paid.

Because of the changes in 2025 (see below), direct deposit has become even more important if you want to avoid delays.

Phase-Out of Paper Checks: What It Means for Refunds in 2026

Starting September 30, 2025, the IRS is phasing out paper refund checks for individual taxpayers.

- Paper checks are more likely to be lost, delayed, or stolen — direct deposit is far safer and faster.

- If you do not provide valid bank account information (or don’t request — and receive — an IRS-approved exception), the IRS may delay refund issuance. For 2025 returns, refund could be held up to 6 weeks if direct deposit info is missing.

- Alternative electronic payment methods (like prepaid debit card or digital wallet) may apply instead of paper checks in certain situations.

Bottom line: For timely refund, e-file + direct deposit (with valid account info) is strongly recommended for 2025 and beyond.

Eligibility for IRS Tax Refund Direct Deposit

To be eligible for direct deposit, you must:

- Provide valid bank account information (routing number + account number) when filing.

- Have the account in your name, your spouse’s name, or a joint account.

- Use an electronic method allowed by IRS (direct deposit, prepaid debit, etc.) — since paper checks are being phased out.

If you fail to submit deposit info (or it’s invalid), IRS may delay your refund or require alternative arrangements.

Why IRS Refunds Sometimes Get Delayed

Even with e-filing and direct deposit, refunds can be delayed due to:

- Errors or incomplete information on your return — wrong SSN, incorrect bank details, math errors.

- Identity-verification or fraud review — especially common if you claim refundable credits (like EITC or CTC).

- Offset for debts — IRS may intercept or reduce refunds to satisfy outstanding federal or state obligations (student loans, child support, tax debt, etc.)

- Paper filing — far slower than e-file + direct deposit.

- Missing direct deposit info (post-2025) — since paper checks are being phased out, missing deposit details could hold up refunds up to six weeks.

Also — the IRS updates refund status only once per day. So checking more often doesn’t speed up your refund.

How to Check IRS Tax Refund Schedule 2025 Status?

Step 1: Wait until your return is accepted.

- For e-filed returns: wait at least 24 hours.

- For paper returns: wait about 4 weeks.

Step 2: Go to “Where’s My Refund?” tool on IRS.gov or open the IRS2Go app.

Step 3: Enter: SSN or ITIN, your filing status, and the exact refund amount your return shows.

Step 4: View status: “Return Received”, “Refund Approved”, or “Refund Sent”. Once “Sent,” direct deposit should hit your bank in 1–5 days (but sometimes longer).

Step 5 (if no update / refund missing):

- Wait at least 5 days after “Refund Sent.”

- If nothing appears — contact IRS or, if paper check was mailed, submit a refund trace (note: as of 2025 paper checks are much rarer).

What the IRS Phase-Out of Paper Checks Means for You

- Electronic payments are becoming the standard. If you file in 2025 (and beyond), be prepared to receive your refund via direct deposit, debit card, or digital wallet.

- Update bank information every year — especially if you changed banks, closed accounts, or changed names. Invalid info may delay your refund.

- Make sure to e-file — electronic filing + direct deposit remains the fastest, most reliable method to get your refund quickly.

- Watch for IRS letters — if your return required review, or if there was a problem with your bank info, the IRS will reach out.

Conclusion About IRS Tax Refund Schedule 2025: What Taxpayers Should Know

The 2026 tax season brings several important updates that every taxpayer should be aware of. From checking your IRS tax refund schedule 2026 status to understanding the shift toward direct deposit over paper checks, the IRS is focused on faster, more secure refund delivery. With the phase-out of paper refund checks beginning for individual taxpayers, direct deposit remains the quickest and safest way to receive your refund and the most accurate when tracking refund dates.

As refundable credits, expanded deductions, and updated IRS processing guidelines shape refund amounts in 2026, staying informed is essential. Always use the official Where’s My Refund? tool to monitor progress, double-check all tax information before filing, and choose direct deposit to avoid delays. Whether you’re expecting a traditional refund or a larger credit-boosted amount, understanding these updates ensures you’re fully prepared for a smooth tax season and a timely refund.

Frequently Asked Question

How long are IRS refunds taking right now?

For most electronically filed returns (with direct deposit), refunds are issued in less than 21 days.

Paper returns — or returns with issues — can take 4–8 weeks or longer.

Why are refunds delayed?

Refunds may be delayed due to: inaccurate or incomplete returns; identity verification or fraud review; errors in bank information; use of paper returns; or offset of refund amount to pay back owed debts (federal or state).

Also, after the 2025 phase-out of paper checks, failing to provide direct-deposit info can delay refunds (up to six weeks while IRS requests info or exception).

How do I check my IRS refund status?

Use the official “Where’s My Refund?” tool on IRS.gov or the IRS2Go mobile app. You need your SSN/ITIN, filing status, and the exact refund amount. The system updates once a day. If you don’t have internet access, you can call the IRS refund hotline.

How do I find out if I’m getting a $1,400 stimulus check (or other rebate)?

While the term “stimulus check” refers to special payments issued in certain years — such as under specific relief laws — refunds you see in WMR are based solely on your tax return and any refundable credits. If you expect additional “rebate” or “stimulus” payments, you can:

- Check IRS notices you received (mail or electronic) — those often list Economic Impact Payment (or rebate) amounts separately.

- Check your IRS Account or “Get My Payment” tool (if applicable for your tax year).

- Review your prior-year tax transcript or tax records, which list all payments/refunds issued including any credits or rebates.

If you haven’t received confirmation of such a payment — that may mean you’re not eligible or the payment was issued previously.

$3000 IRS tax refund schedule 2025 who qualifies

You may qualify if you meet one or more of the following conditions:

You’re eligible for the Earned Income Tax Credit (EITC) — especially families with children, where refund amounts can exceed $3,000.

- You claim the Child Tax Credit (CTC) — refundable portion can increase your total refund.

- You had higher federal tax withholding during 2024.

- You qualify for education credits, such as the American Opportunity Credit.

- You contributed to retirement accounts that lower taxable income.

- You qualify for energy-efficient home improvement credits or clean vehicle credits.

- You’re eligible for any state-level rebates that increase total refund amounts.

Refund amounts can vary by income, deductions, credits claimed, and tax liability. The IRS has not announced a special or new $3,000 refund program, but certain taxpayers may still receive refunds of $3,000 or more depending on their 2024 tax return.