$3,000 IRS Tax Refund Schedule 2025: Rumoured or Reality?

Over the past few months, a rumor has been spreading across social media about a $3,000 IRS Tax Refund Schedule 2025. Many taxpayers want to know whether the IRS really plans to issue this payout and when they should expect their refund next year.

Let’s clear the confusion about $3,000 IRS Tax Refund Schedule 2025.

The IRS has not officially announced a guaranteed $3,000 refund for all Americans. The number circulating online mostly comes from clickbait posts, misinterpretations of tax credit changes, and viral videos. However, certain taxpayers may see refunds around or above $3,000 depending on their income, credits, and current tax laws.

Here’s a complete, easy-to-understand guide that breaks down the truth, the real refund timeline, how to check your refund status, and answers to all the questions people are asking.

Is the IRS Really Giving Out $3,000 in 2025?

No, not as a universal payment. There is no federal program that guarantees every taxpayer a $3,000 refund in 2025. Refund amounts vary based on:

- Your income bracket

- Federal withholding

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Deductions and adjustments

- Filing status

So, while some people may receive a refund near $3,000 or more, it is not a promised amount from the government.

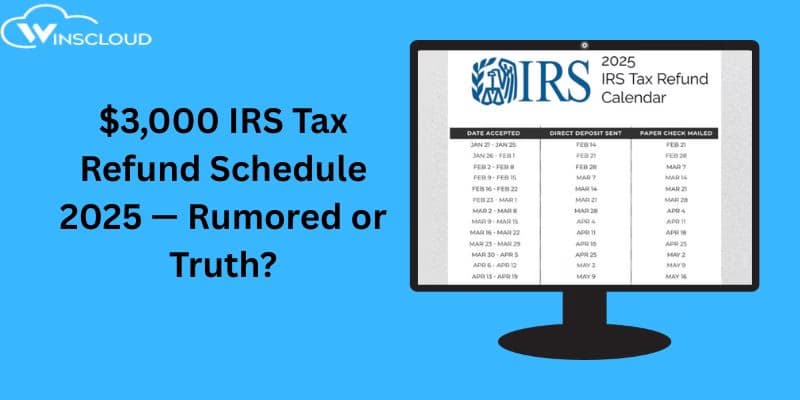

$3,000 IRS Tax Refund Schedule 2025: When You Can Expect Your Money

The IRS typically begins processing tax returns in the last week of January and issues refunds 21 days after accepting your return, assuming there are no delays.

Below is a simple, easy-to-read refund schedule many filers find helpful:

2025 Estimated IRS Refund Schedule

| If You File Your Return Between | IRS Acceptance Window | Estimated Refund Date (Direct Deposit) |

|---|---|---|

| Jan 20 – Jan 26 | Jan 27 – Feb 1 | Feb 7 – Feb 14 |

| Jan 27 – Feb 2 | Feb 3 – Feb 8 | Feb 14 – Feb 21 |

| Feb 3 – Feb 9 | Feb 10 – Feb 15 | Feb 21 – Feb 28 |

| Feb 10 – Feb 16 | Feb 17 – Feb 22 | Feb 28 – Mar 7 |

| Feb 17 – Feb 23 | Feb 24 – Mar 1 | Mar 7 – Mar 14 |

| Feb 24 – Mar 2 | Mar 3 – Mar 8 | Mar 14 – Mar 21 |

| Mar 3 – Mar 9 | Mar 10 – Mar 15 | Mar 21 – Mar 28 |

Note: Paper filers and returns that include EITC/CTC may take longer.

Is the IRS Sending $3,000 Refunds in June 2025?

There is no IRS statement that says taxpayers will receive $3,000 payments specifically in June 2025.

Any June refunds would apply only to those filing late, filing amended returns, or receiving delayed refunds due to verification issues.

How to Check Your Refund Status

Checking your IRS refund status is simple and takes less than a minute.

Option 1: IRS “Where’s My Refund?” Tool

You can use the official IRS tracker on the IRS website.

Just select “Where’s My Refund?” and enter:

- Your Social Security Number

- Filing status

- Exact refund amount

This tool updates the status once every 24 hours.

Option 2: IRS2Go Mobile App

The IRS also provides real-time refund updates through its official mobile app.

You will see one of three statuses:

- Return Received

- Refund Approved

- Refund Sent

If the IRS needs to review your return, you may also receive a mailed notice explaining what they need.

How to Get a $10,000 Tax Refund in 2025

A $10,000 refund is possible — but it’s not automatic. Taxpayers generally reach this amount through a combination of credits and withholding.

Ways people commonly receive large refunds:

1. Multiple children qualifying for CTC or EITC

Families with two or more qualifying children often see higher refunds.

2. Significant federal tax withholding

Many salaried workers have more withheld than necessary.

3. Eligibility for refundable credits

Such as the Earned Income Tax Credit and Additional Child Tax Credit.

4. Claiming deductions

Student loan interest, education credits, and itemized deductions can increase refund size.

Remember: a bigger refund usually means you withheld too much during the year.

What’s the Truth Behind the $3,000 IRS Tax Refund Schedule 2025 Rumour?

The rumor is built mostly on:

- Old posts resurfacing from pandemic-era payments

- Misinterpreted tax credit changes

- Viral social media videos

- Misleading blogs targeting search traffic

No federal law has been passed that mandates a universal $3,000 IRS Tax Refund Schedule 2025.

As always, the IRS website is the most reliable source for tax announcements.

Frequently Asked Questions

1. Is the IRS giving out $3,000?

No. The IRS is not giving every taxpayer a $3,000 refund in 2025. Refund amounts depend entirely on your tax situation.

2. When can you expect your IRS tax refund in 2025?

Most direct deposit refunds arrive within 21 days after the IRS accepts your return.

3. Is the IRS sending $3,000 refunds in June 2025?

No. There is no official plan for June payments. Only late-filed or delayed refunds may arrive in June.

4. How can I get a $10,000 tax refund in 2025?

Large refunds usually come from high withholding, multiple dependents, EITC, or major deductions and credits.

$3000 IRS tax refund schedule 2025 who qualifies

The rumored $3,000 IRS Tax Refund Schedule 2025 does not have any official qualification criteria, because the IRS has not announced any program that gives all taxpayers a flat $3,000 refund. As of now, the only people who could receive around $3,000 in refunds are those whose normal tax return calculations result in that amount—meaning their withholding, tax credits (such as the Earned Income Tax Credit or Child Tax Credit), and deductions collectively lead to a refund of roughly $3,000. In short, there is no special IRS-approved group—no low-income bracket, no Social Security recipients, no veterans, and no parents—with automatic eligibility for a $3,000 payment. Contact Winscloud for Drake hosting, ProSeries hosting Sage 50 hosting provider and more.